Bain Reports Private Equity Industry’s Supersized First Half of 2021

Private equity numbers “blow the cover” off the record books in 2021, despite Covid-19.

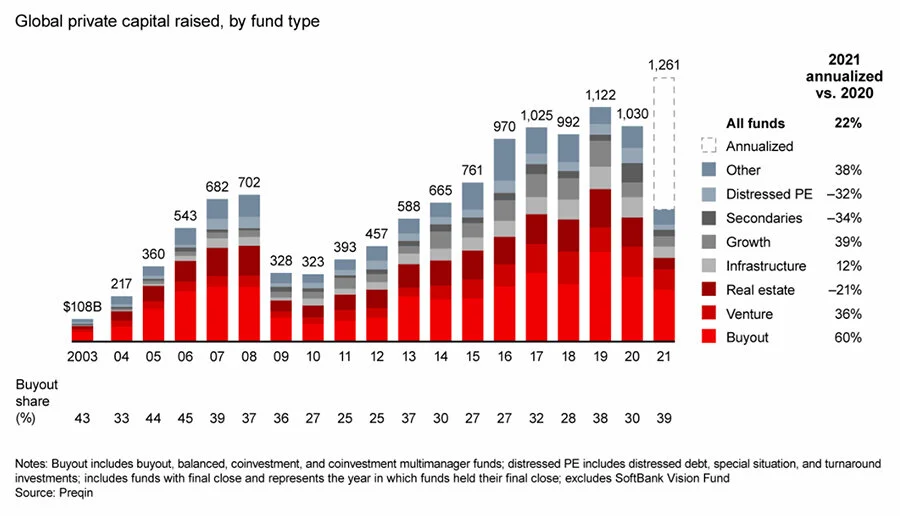

Private company fund-raising has tripled since 2011 and may exceed $1 trillion by 2022.

Deal size, not deal count, shapes the total of equity funding. One in three deals involve technology companies (especially software).

Special Purpose Acquisition Companies (SPACs) are still active, but more regulated.

The rush to public markets is on fire, with $90 billion in exits so far in 2021. Investor interest remains high.

Source: Bain & Company

Innovative companies can sustain growth by optimizing their processes to meet rapidly changing business requirements. Kure’s Process Optimization Path™ empowers teams to scale process optimization company-wide – creating a solid foundation for business growth.